DORIAN LPG (LPG)·Q3 2026 Earnings Summary

Dorian LPG Beats Revenue But Misses EPS as TCE Rates Lag Guidance

February 5, 2026 · by Fintool AI Agent

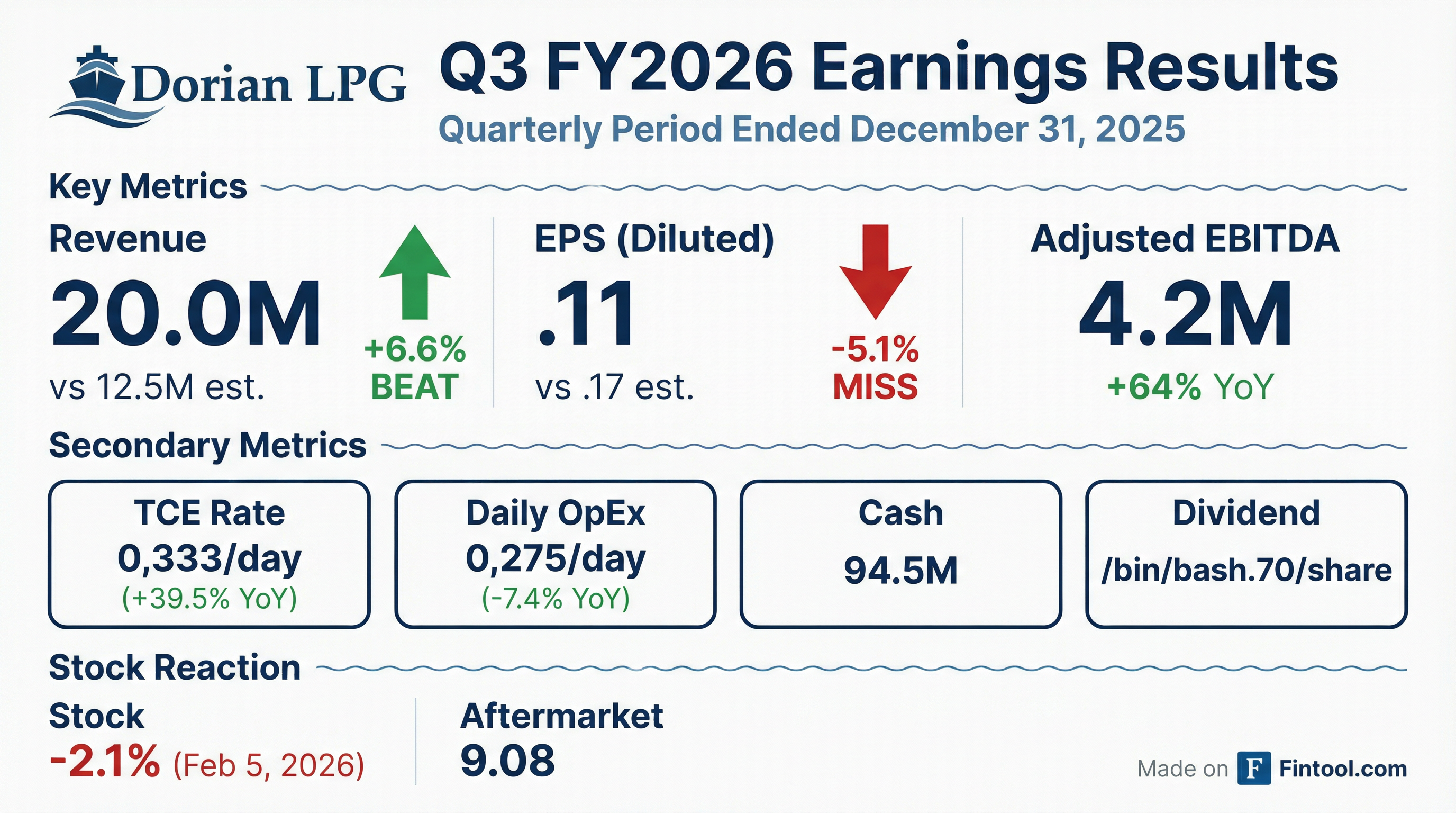

Dorian LPG (NYSE: LPG) reported Q3 FY2026 results that beat revenue expectations but missed on earnings per share. Revenue of $120.0M topped the $112.5M consensus by 6.6%, while EPS of $1.11 fell 5.1% short of the $1.17 estimate.

Net income more than doubled year-over-year to $47.2M, driven by a 39.5% surge in TCE rates and lower operating costs. However, the stock fell 2.1% to $29.72 on the day, with aftermarket trading pushing it down further to $29.08—likely reflecting disappointment that TCE rates of $50,333 came in well below the ~$57,000/day guidance management provided last quarter.

Did Dorian LPG Beat Earnings?

Mixed results: Revenue beat snapped a 5-quarter miss streak, but EPS missed for the 6th consecutive quarter.

Values retrieved from S&P Global

Key Drivers

Why revenue beat:

- TCE rates of $50,333/day were up 39.5% YoY from $36,071

- Available days increased to 2,349 from 2,210 YoY due to fleet expansion

- Lower bunker fuel costs (VLSFO down to $452/mt from $570/mt)

Why EPS missed:

- TCE rates of $50,333 fell well short of the ~$57,000/day guidance

- G&A expenses jumped 44% YoY to $10.8M due to cash incentive plan accruals

- Charter hire expenses increased $7.6M due to higher time chartered-in fleet

Historical Beat/Miss Record

Dorian LPG has now missed EPS estimates for 6 consecutive quarters, though this quarter finally broke the revenue miss streak.

Values retrieved from S&P Global

How Did the Stock React?

LPG shares fell 2.1% to $29.72 on earnings day, with aftermarket trading down further to $29.08. Despite the revenue beat, the market appears focused on:

- TCE rate miss: $50,333 vs ~$57,000 guidance

- Continued EPS misses: 6th straight quarter

- Rising G&A costs: Cash incentive accruals jumping $2M

The stock has still performed well YTD, up ~21% from the lows, reflecting improved freight market conditions since the trough in mid-2025.

What Did Management Say?

CEO John Hadjipateras struck an optimistic tone despite the EPS miss:

"Our dividend declared last week of $0.70 per share, totaling $29.9 million, will be our eighteenth dividend payment, bringing total dividends distributed to over $725 million, and total capital of $961 million returned to shareholders since our IPO."

Capital Returns Highlight

The $0.70/share dividend maintains Dorian's aggressive capital return program:

What Changed From Last Quarter?

TCE Rates: Guidance vs. Reality

Management had guided to ~75% of Q3 fixable days booked at ~$57,000/day. The actual TCE of $50,333 fell ~12% short, attributed to:

- Softer November rates: Market rates for December loadings were lower than prior months

- Houston fog delays: Unexpected waiting time in Houston Ship Channel hurt utilization

- Saudi CP decline: October's $25/mt propane CP cut created market uncertainty

Market Conditions

The quarter saw significant volatility from U.S.-China port fee uncertainty, which was ultimately suspended in November 2025.

Operating Performance

Fleet Efficiency

Operating expense reduction was driven by lower non-capitalizable drydock costs and reduced spares/stores expenses.

Balance Sheet

The company maintains substantial liquidity with an additional $50M undrawn revolver available.

Forward Outlook

Fleet Developments

- Newbuild delivery: Dual-fuel VLGC/AC expected in March 2026

- Fleet composition: 27 VLGCs (20 ECO, 5 dual-fuel ECO, 2 modern)

- Time charter expirations: Challenger in Q3 2026, Commodore and Chaparral in Q3 2027

Industry Outlook

The VLGC market outlook remains constructive:

- Orderbook: 111 VLGCs scheduled through 2029 (~27% of existing fleet)

- Fleet age: Average 12.0 years

- Demand: Management notes freight rates "have continued to be strong into the current quarter"

Consensus Estimates

Values retrieved from S&P Global

Q&A Highlights

Counter-Seasonal Rate Strength

Analyst Omar Nokta (Clarkson Securities) asked why rates are at 2+ year highs despite typical seasonal softness. Tim Hansen explained it's a spillover effect from Q4 2025 uncertainty:

"There was a lot of uncertainties and people held back on the activity. So there's a little bit less cargoes lifted. There was some fog as well in the US... Once all these, the USG was cleared, once the fog have lifted and people had gotten used to these Saudi pricing, the market came back."

Management noted production levels continue to surprise to the upside, and U.S. terminals have successfully cleared the cargo backlog. Outlook for 2026 remains "pretty positive."

Fleet Speed Limitations

When asked about the fleet's ability to speed up in a strong rate environment, Tim Hansen acknowledged limited upside:

"There is a bit of leeway in speeding up still, but most of the, let's say, non-LPG fuel ships... are still capped by the environmental regulations and the reductions of power done years back. So there's maybe like a knot or two more in it."

Bad weather over the winter has also constrained actual speed improvements even when theoretically possible.

Energy-Saving Device ROI

John Lycouris provided color on the payback from fleet efficiency investments:

"The energy-saving devices... usually provide an improvement of around 5%. And that's the ballpark figure for most of the energy-saving devices in most of the ships. And silicon paints also provide a similar kind of number, about 5% improvement... The payback is generally pretty fast. It is generally within a year."

Scrubbers have longer payback periods but continue generating savings despite lower fuel differentials.

Brazil as Emerging Growth Market

CFO Ted Young highlighted a charter deal (likely the Chaparral TC into 2027) that involves business for Brazil:

"I also think it's probably, you know, was reported, which I think is interesting, that it's business for Brazil, which I think is pretty exciting because of what it says about Brazil as a potential growth market."

Newbuild Financing

The remaining ~$62M payment for the March 2026 VLGC/VLAC newbuild will be financed rather than paid from cash, preserving liquidity.

Environmental Performance

Dorian continues to outperform on emissions metrics:

IMO Regulatory Update: The Marine Environment Protection Committee delayed approving MARPOL Annex VI changes by one year. Management views this as "a very positive step, allowing more time for input and review on many outstanding technical issues." MEPC 84 scheduled for spring 2026.

The Bottom Line

Dorian LPG's Q3 2026 results were a mixed bag that failed to inspire investors:

Positives:

- Revenue beat broke 5-quarter miss streak (+6.6%)

- Net income more than doubled YoY to $47.2M

- TCE rates up 39.5% YoY

- Operating costs down 7.4%

- 18th dividend payment maintains strong capital return track record (>$961M returned since IPO)

- "Strong" demand continuing into Q4 with counter-seasonal rate strength

- Fleet AER 10.4% better than IMO requirements

- Brazil emerging as potential growth market

Concerns:

- 6th consecutive EPS miss (-5.1%)

- TCE rates of $50,333 missed ~$57,000 guidance by 12%

- G&A costs jumped 44% on incentive accruals

- Stock down 2.1% despite revenue beat

- Market uncertainty from U.S.-China trade tensions persists

The company's modern fleet and strong balance sheet (17% net debt/cap, $345M liquidity) position it well for the cycle, but management's credibility on guidance has been challenged after multiple misses. Investors will be watching Q4 forward bookings closely.

Analysis based on the 8-K filed February 5, 2026, Q3 FY2026 earnings slide presentation, and earnings call transcript.